Interestingly, the value-added tax appeared first in the academic research of the American economist T. Congress only took into consideration the implementation of a federal (nation-wide) sales tax as a source for revenue to finance World War II. Instead, sales taxes are levied and controlled at the state (sub-national) and local (sub-state) levels, where they account for a significant part of state and local revenue. Sales Tax Rate is the state sales tax as a decimal for calculations.

Streamline your accounting and save time

New York, on the other hand, only raises about 20 percent of its revenues from the sales tax. The only thing to remember in our “Reverse Sales Tax Calculator” is that the top input box is for the sales tax percentage, and the bottom input box is for the total purchase price. It’s important to check the specific rules and regulations in your jurisdiction as the items subject to sales tax can vary. If you were supposed to collect sales tax and didn’t, you could be looking at high financial penalties and interest.

Ставки налога с продаж, дополнительные налоги с продаж и сборы (Sales tax rates, additional sales taxes, and fees)

In other countries, the listed prices are the final after-tax values, which include the sales tax. A sales tax is a tax charged by state and local governments on most goods and services. Consumers typically pay the tax at the point of sale, and it is calculated by multiplying the sales tax rate by the price of the sales tax decalculator formula good or service being purchased. As you go through the receipts, you may want to find out how much is the sales tax and how much is your actual income. Rather than calculating the sales tax from the purchase amount, it’s easier to calculate the sales tax in reverse then separate this amount from the total amount.

Is my business required to collect sales tax?

- Please refer to our Editorial Policies page for further details on our editorial standards.

- Statewide sales taxes are collected by 45 states and the District of Columbia.

- Depending on the amount of taxes you owe, your filing and paying frequency might be less frequent.

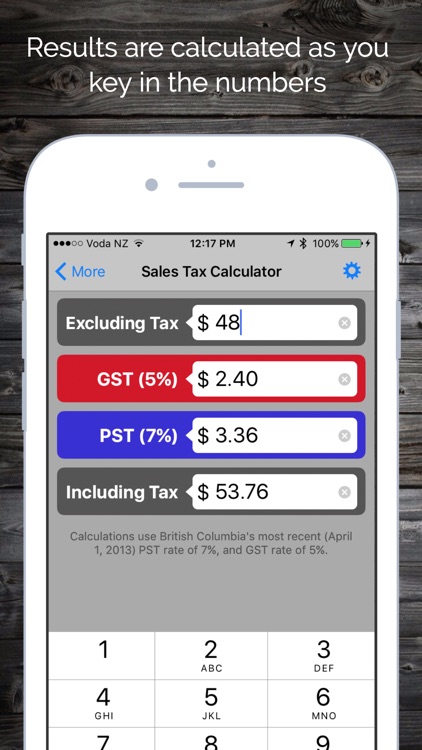

- This sales tax decalculator template will help you calculate the pre-tax price of a good or service when the total price and tax rate are known.

- The cooper then makes a barrel that he can sell for $300 to the retailer who eventually sells it to the customer for $350.

Mississippi was the first in 1930, and it quickly was adopted across the nation. Today, sales tax is imposed in most states as a necessary and generally effective means to raise revenue for state and local governments. The sales tax rate ranges from 0% to 16% depending on the state and the type of good or service, and all states differ in their enforcement of sales tax.

On the other hand, the requirement to collect sales tax for services varies based on state laws. Businesses that sell taxable goods or services must get a sales tax license from the appropriate state and charge sales tax. As a small business seller, it’s your responsibility to ensure you collect the correct tax amount and pay it to the state. A business is liable for remitting sales tax in any tax jurisdiction in which it has nexus, whether it’s a physical or economic one. It’s a consumption tax that is imposed by the U.S. government on the sale of goods and services. This tax is collected by vendors from the consumers when they make purchases.

The result you get is the tax rate on the item you paid, and it’s expressed as a decimal number. Use this reverse sales tax calculator whenever you need to check the number of items purchased before paying sales tax. To calculate the sales tax amount, you need to know the net price of the item and the sales tax rate at the location where you buy the item. Some states do not charge sales tax on specific categories of items. In Massachusetts for example sales tax is not charged on regular grocery items.

For some individuals, knowing how much sales they paid is essential for filling out correct tax returns and receiving monetary credit for overpaid sales tax. This is especially beneficial if you have to list your out-of-state purchases to you current state of residence and the taxes paid on those purchases. For example, say you purchased a new phone and your total credit card charge was $858. To see this, let’s consider a rise in the sales tax rate in a state. Such a situation may happen in sectors where the competition is high among sellers, or the consumer demand is more sensitive to price changes.

Rules and regulations regarding sales tax vary widely from state to state. When selling online, businesses may still need to charge sales tax, also known as internet sales tax. If a business has nexus in a state, regardless of whether it operates online or through physical locations, it may be required to collect and remit sales tax on sales made to customers in that state. For tangible goods, the requirement to collect sales tax is straightforward.